Corporate Landlord Touts "Embedded Rent Growth Potential"

Blackstone sees profit opportunity in the housing crisis while getting a bailout from the University of California.

Note: I’m publishing some regular musings here. Use this button to subscribe, which will alert you to them and sign you up to The Lever’s free email newsletter.

The CEO of America’s largest corporate landlord — who is one of the GOP’s largest donors — just raked in $1.2 billion of personal compensation last year. Now as The Lever reports, his company’s beleaguered investment vehicle is getting a giant bailout from the University of California, whose students are struggling to afford housing.

What’s more, that $4.5 billion investment of public funds is going into a specific Blackstone investment vehicle whose returns are explicitly predicated on jacking up rents even more, according to Blackstone’s own corporate documents.

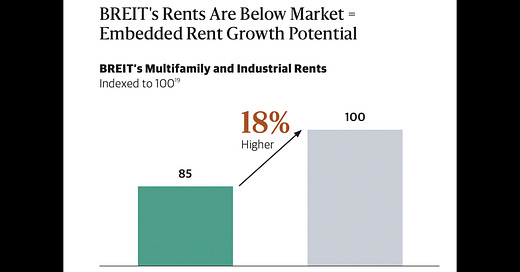

Peruse the annual report of the Blackstone Real Estate Investment Trust (BREIT), which received the infusion of UC cash while blocking redemption requests from other investors worried about cratering real estate values. Look closely at the section of the report saying that “we believe BREIT has significant momentum heading into 2023.” You’ll see the graph embedded above — the one in which Blackstone executives are salivating at the prospect of “Embedded Rent Growth Potential.”

That’s Wall Street-ese for a huge profit opportunity in jacking up rents on tenants and businesses all across America. In this case, Blackstone is alleging its current rents are below market, and then projecting the company’s potential profits in hiking those rents by up to 18 percent.

Blackstone execs will have an easier time acting on that desire after they spent millions of dollars killing a rent control ballot measure in California. Indeed, in BREIT’s annual report, Blackstone executives identify such tenant protections as a major threat to their profits.

“These initiatives and any other future enactments of rent control or rent stabilization laws or other laws regulating rental housing, as well as any lawsuits against us arising from such rent control or other laws, may reduce rental revenues or increase operating costs,” the company writes. “Such laws and regulations may limit our ability to charge market rents, increase rents, evict tenants or recover increases in our operating costs.”

This is is the predatory business model that California public officials are now supporting. They are deploying $4.5 billion of public university money not on construction of new affordable housing, instead wagering that cash on a plan helping Wall Street moguls extract even more rents from Californians.

If you like this post, pitch in to the tip jar for The Lever, an award-winning reader-supported investigative news outlet that holds the powerful accountable.

Rent takers are parasites.